- Borrowers

- Frequently Asked Questions

Frequently Asked Questions

General Inquiries

Does the home have to be on permanent foundation?

No. We can do singlewide and doublewide homes with or without a permanent foundation. This allows for mobile or manufactured house financing on rental land, in parks, leased property or family land.

What is the maximum loan to value?

Up to 95% LTV on a primary residence purchase. Closing cost can be financed on top of the loan or seller concessions may be used. Credit scores will make the final determination of LTV.

Is Homeowners insurance required and how much?

The borrower must provide proof of one year full coverage at the time of closing. We offer competitive insurance rates. If Triad Financial Services, Inc. policy is accepted, the 1st year's premium can be financed.

Who orders the appraisal, title work, loan closings and etc.?

Triad Financial Services will order all necessary work on the manufactured home loan. We will select the appraiser. The realtor, dealer or the customer may select the title company.

Where do the loans close?

On a home only loan, the realtor / dealer holds the closing, or we will mail the documents directly to you. A notary must notarize several forms. Funds will be disbursed within 48 hours after we receive the closed loan package back in our office. (Note: By law we are unable to pay commissions directly to the realtor - this must be arranged for the seller to pay out of their proceeds.) On a land / home loan, all real estate transactions must close with a title company or attorney. Funds will be disbursed at the closing table.

Can the home be purchased through a dealer?

All loan applications must be submitted by a Triad Financial Services, Inc. approved dealer. Please contact the dealership to apply.

What age of a home can be financed?

Age of Home 1976 or newer.

How long does it take between loan application and closing?

Approximately two to three weeks for home-only and four to five weeks for land/home. Our closing department will schedule your loan closing.

What closing fees are charged?

Our closing fees will vary depending on the loan program (home-only vs. land/home) and state the home is located in (state imposed fees). Closing cost can be financed into the loan if necessary.

What about the survey and termite letter?

Triad Financial Services, Inc. does not require a survey or termite letter on the property unless the Title Company is unable to provide title insurance without one. If the customer requests a survey or termite inspection, they must pay for it out of pocket. We will not finance the cost of a survey or termite inspection unless it is a requirement of the Title Company.

Escrow

What is an escrow account?

An escrow account is a way to manage property taxes and insurance premiums. You make one monthly payment where part goes toward your mortgage and the other part goes into your escrow account for property taxes and insurance premiums (like homeowner's insurance, mortgage insurance, or flood insurance). When those bills are due, we use the funds in your escrow account to pay them.

How is escrow calculated?

Your monthly escrow payment is determined by taking your latest tax and insurance bill and dividing the annual amounts due by 12.

For example, say your yearly property taxes are estimated to be $1,200 and your yearly homeowners insurance, $600. That's a total of $1,800 for the coming year. We divide that by 12 and there's the escrow portion of your total monthly mortgage payment: $150.

Then we calculate your minimum balance/cushion amount. To help you plan for any potential increases, a minimum balance needs to be kept in your account at all times. It can be up to two months of escrow payments.

What is an escrow account cushion?

An escrow account cushion is an additional amount collected as a safeguard to cover unanticipated increases in taxes and insurance premiums. Cushions vary by state, but the amount cannot exceed two monthly escrow payments. The escrow account cushion amount is also the minimum balance amount required for your escrow account. Cushions vary by state

What is an escrow account analysis?

An escrow account analysis is completed at least once every 12 months to ensure we are collecting the accurate amounts for taxes and insurance. This is because property tax amounts and insurance premiums for your home can, and often do, change year after year. If after the analysis your escrow account balance is below the minimum amount required, then you will have a shortage. If the balance is above the minimum amount required, then you will have an overage.

What is an escrow shortage?

A shortage occurs when the escrow account balance is below the minimum amount required. The most common causes of an escrow account shortage are increases in taxes and insurance premiums.

How is an escrow shortage collected?

You have the following options to repay your Escrow Shortage:

- Repay the Escrow Shortage Monthly - The total shortage is divided over 12 months and will automatically be added to your monthly payment, unless you repay the escrow shortage in full.

- Repay the Escrow Shortage in Full - You may pay the escrow shortage in full by mailing in the shortage amount with the Escrow Shortage Coupon provided on your Escrow Analysis Statement. Upon receipt, the shortage portion of your monthly payment will be removed.

What is an escrow overage/surplus?

An overage/surplus occurs when the escrow account balance is above the minimum amount required. In this instance, an overage/surplus check will be sent to the mailing address on file. Your account needs to be current for the overage/surplus check to be mailed.

Can I use my escrow overage/surplus check toward my monthly payment?

We do not apply the escrow overage to the monthly payment.

Insurance

What is a Mortgagee Clause?

The mortgagee clause is an important provision in a property insurance policy that ensures that the insurance company will pay the mortgagee in the event that loss or damage occurs to a mortgagor's property. The clause is an important measure that mortgagees take to protect their investment in a mortgagor's property

Investor Name ISAOA/ ATIMA

C/O Triad Financial services, Inc.

13901 Sutton Park Drive South, suite 300

Jacksonville, FL 32224

Does Triad offer insurance products?

Triad Financial Services, Inc. offers consumers, manufactured home dealers and communities affordable insurance programs for both new and used manufactured homes.

Triad's insurance division has multiple national insurance companies available to customize an insurance program to meet your needs. Carriers offer coverage on consumer homes, attached structures, and personal property as well as options such as personal liability, guest medical payments, loss of use, and special endorsements. We will assist all consumers and dealers with insurance coverage, there is no Triad loan or inventory finance requirement to secure insurance coverage from our team.

The programs we offer are:

- Homeowners Insurance

- Manufactured Home Dealers

- General Liability Insurance

- Open Lot Inventory Insurance

- Manufactured Home Community Rentals Insurance

To request a quote or obtain additional information, please contact our insurance specialists at 1-800-522-2013 x1609.

How much coverage am I required to have?

Coverage for new and some pre-owned homes are based on the replacement cost value of the home. Replacement cost is the dollar value it costs to replace the home at current prices.

Older homes are covered based on their actual cash value (ACV), which is the amount to replace the home or item minus depreciation. Depreciation is the estimated decrease in value over time due to wear and tear, aging and other related factors.

Insurance Claim/Loss Draft

What is a loss draft?

A loss draft is a check an insurer will issue to a home owner for damage(s) via natural disasters suffered to their property. An agent from the insurer will commonly come to inspect the damage before issuing a loss draft. After the you and the insurer have come to terms on the estimated amount to repair the damage, the insurer will issue a loss draft, also known as a loss draft check or claim check. The loss draft will be co-payable to the you and to Triad Financial Services.

Why is the insurance claim check also made out to Triad?

Your mortgage servicer, or lender, is a co-insured with you to protect their interest in collateral.

When you buy a home with a mortgage, your lender has a security interest in the house. Lenders must protect the value of your home just as you would. When your home is damaged by a covered loss, your mortgage servicing company, or lender, is also a loss payee as a "co-insured" with you. Insurance companies issue claim checks in both your name and in the mortgage servicing company or lenders name. This feature enables your mortgage servicing company or lender to ensure that these funds are used to make necessary repairs.

What is the claims process?

When a property securing a mortgage loan experiences an insured loss, Triad must ensure the proof of loss claim is filed within the time period specified in the insurance policy and monitor the disbursement of insurance loss proceeds.

Our Loss Draft Specialist will:

- Obtain complete details on the damage to the property and determine the needed repairs, ensure the proof of loss claim is filed within the time period specified in the insurance policy, and monitor the disbursement of insurance loss proceeds.

- Discuss with you any plans for repairing the property, if applicable.

- Deposit any funds not disbursed into a custodial account, if applicable.

- Review and approve the final plans for repair, including obtaining the necessary bids to repair the property, if necessary.

- Monitor and validate repairs completed comply with the final repair plan.

- Obtain the proper lien releases if the property is paid in full utilizing the claim funds

Triad will partner with you during the entire claim process to ensure we take care of you and your property.

I have damage to my property. What do I do?

You first need to call your insurance company to file the claim. Once the claim has been filed and you have the insurance claims/loss draft check, please call us at (877) 426-8362 or email at claims@triadfs.com, and we will provide the next steps.

What is the claims/loss department’s address?

Triad Financial Services

13901 Sutton Park Drive South, Suite 300

Jacksonville, FL 32224

Attn: Claims

Taxes

I received a tax bill. Do I send it to you?

No. If your loan has an escrow account, you do not need to send us the bill. We receive an electronic version of your bill, and we pay it for you.

An exception is if you get a delinquent or corrected tax bill. We'll also pay that bill from your escrow account, but you need to send us a copy of it. Either scan the bill or take a good-quality photo and email it to us at escrow@triadfs.com, or via fax at 866-874-2334.

Note: If your mortgage does not have an escrow account, you must pay all tax bills yourself.

I received a supplemental/interim tax bill. Do you pay this?

You are responsible for paying any supplemental/interim tax bills.

How do I know you paid my taxes?

You can view any tax disbursements by logging into your account and viewing your payment history.

Website Registration

How do I create an online account?

To access your account online, you must first register where you see an "Access my Account" link. Before you begin please clear your cache, cookies and temp files from your browser.

What are the user name requirements?

The user name cannot include special characters and cannot be duplicated in the system. Therefore, the name you've chosen may already have been used. If this occurs, you will get an error message "invalid credentials". Please try your registration again with something unique.

Example: JSmith may already be in use so please try JSmith12345

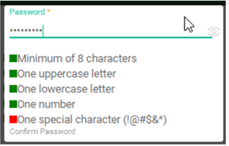

What are the password requirements?

Must adhere to the rules displayed (see below). When the below list first appears ALL items will have a RED box next to it. As you successfully complete each item the boxes will turn Green. Only !@#$&* are acceptable special characters

Payments

Where can I mail my payment and do I need a coupon?

You do not need a coupon to make a payment. Simply write your loan number on the check and mail it to the address below. If you are paying additional funds, please indicate where you intend for the funds to be placed.

Triad Financial

P O Box 7989

Carol Stream, IL 60197-7989

What are my payment options?

We have a multitude of payment options available.

- Automatic Drafting: You may choose to have your mortgage payment withdrawn from your bank account. This is a free, convenient service.

- Triad's Website: You may pay online by logging into your account.

- Bill-pay: You may pay using your banks online bill-pay service, or any other online payment system. Please ensure you have Triad Financial Services listed as the payee and list the loan number in the note section if applicable. Please note the turn time on the website you are utilizing, as some institutions will pay electronically and some will send a check on your behalf.

- Customer Service: You may contact our phone agents at (877) 426-8362 to take your payment over the phone.

- Check or money order: If you receive paper statements from us, be sure to include your payment coupon with your payment. Also, remember to write your Triad account number on your check or money order.

Why did my payment change?

The most common reason for a payment change is due to an escrow account analysis. Please see the Escrow section of our FAQ's for more details. Another reason could be due to an adjustable rate mortgage. Any upcoming interest rate changes are preceded with a mailed notice of the change. Please ensure you review all mail from Triad Financial Services to ensure you are aware of any upcoming adjustments. You may contact our phone agents at (877) 426-8362 for more details.

Why am I not able to pay online?

If our online payment system is not letting you make a payment, there may be an outstanding issue with your account. Please contact a phone agent at (877) 426-8362 so that we may assist you.

Can I cancel my automatic drafting?

You may cancel automatic drafting; however, we need a 5 business day notice prior to the scheduled draft date.

How can I pay extra to principal or escrow.

You may pay additional principal or escrow by logging into your account or mailing in your payment. If you mail in the funds, please make sure to indicate where the additional funds are to be placed.

Can I pay my loan ahead?

Triad will allow you to pay your loan ahead up to three months.

I did not receive my monthly billing statement. How do I pay?

You do not need the statement to make a payment. You may pay online by accessing your account, through your banks bill-pay service, or by check or money order. Please makes sure to reference your loan number.

You can always get a copy of your monthly statement by accessing your account at triadfs.com.

Tip: Always make sure your mailing address is up to date!

I am struggling to make my monthly payments. What do I do?

Call us at (877) 426-8362 so we can assist you with your financial needs.

Payoff Processing

How do I request a payoff statement?

You can create a payoff statement through the following:

- Logging into your account online.

- Via fax to (866) 874-2334

- Email payoffrequest@triadfs.com

- Calling an agent at 877-426-8362

If you are requesting a payoff quote in writing, please provide a good through date (now more than 30 days).

I plan to pay off my loan soon, but taxes/insurance are coming due. Will you pay them?

Unless specifically directed by you not to, Triad will disburse funds to pay upcoming taxes or insurance premiums due. If you do not have enough funds in escrow to cover this disbursement, this could affect the payoff amount.

What happens to my escrow balance after my loan is paid in full?

Any remaining escrow funds will be remitted to you within 20 days of payoff. Please make sure we have the most up-to-date address information so that the funds reach you as intended.

Service Transfers

Why did my loan transfer to Triad?

Service transfers are very common and in no way change the terms, balance or interest rate of the loan from those set forth in the documents you originally signed.

Will my automatic drafting transfer as well?

Most likely, no. You will need to set up automatic drafting directly with Triad Financial Services. If the automatic drafting does transfer, you will be made aware in your servicing transfer notice.

I did not know my account was transferring and made my payment to the prior servicer. What do I do?

Don't worry, your payment will be forwarded to Triad Financial Services. As this is a common practice, your account will be blocked from any late fees or negative credit reporting for 60 days post transfer.

Do I need to update my bill pay service?

Yes. Please update the Payee to Triad Financial Services and the loan number to your loan number with Triad.

%20(1200%20%C3%97%20200%20px).png)