3 Innovative Ways to Improve Your Credit Union's Loan Portfolio

April 22, 2016

Recent data from the Federal Reserve System confirms that loan portfolios recorded in 2015 the lowest delinquency rate since 2008. While decreasing delinquency rates is good news for the entire mortgage industry, including the manufactured home lending sector, a low rate of default doesn’t ensure mortgage portfolio profitability. To reduce loan portfolio risks and enhance overall performance, a credit union operating within the home loan sector must come up with an innovative portfolio optimization strategy.

Going Beyond the Obvious

When it comes to reducing loan portfolio risks and enhancing performance, diversification is a prominent investment tenet. However, financial institutions often fall into the pitfalls of over diversification. From an investment perspective, over diversification is riskier than under diversification. That’s because each additional product added to a credit union’s loan portfolio lowers the overall risk, but by a smaller and smaller amount, according to industry experts. Over diversification might also require additional capital, result in asset duplication and make tracking different asset classes difficult. All these will ultimately affect the portfolio, potentially leading to underperforming, which will negatively impact returns.

How can you improve your credit union’s loan portfolio without running the risk of over diversifying it? That’s quite simple: by adding a category of low-risk financial products proven to generate high-yield returns, such as manufactured home loans. Here are three innovative ways our manufactured home lending programs can enhance your portfolio.

1. Manufactured home loans are growing in popularity.

The current affordable housing crisis and the growth rate of older population, which is projected to double in size by 2050 based on recent Census data, are driving the demand for manufactured homes and financing options at a faster pace than predicted. The

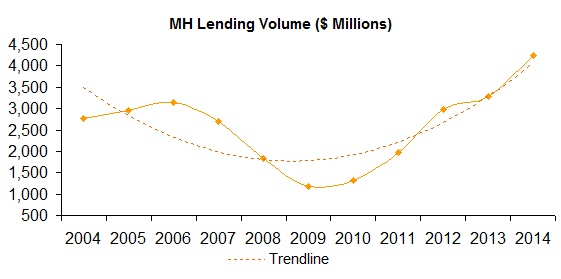

recent increase in demand for affordable housing and finance alternatives has already started to have a positive impact on the entire manufactured housing industry, including the lending sector. Consequently, the financial institutions operating across the secondary market for manufactured home loans have reported tremendous growth over the past three years, as shown in the adjoining chart.

recent increase in demand for affordable housing and finance alternatives has already started to have a positive impact on the entire manufactured housing industry, including the lending sector. Consequently, the financial institutions operating across the secondary market for manufactured home loans have reported tremendous growth over the past three years, as shown in the adjoining chart.

As a leading manufactured housing finance company established in 1959, Triad Financial Services is the living proof that manufactured home loans have historically provided positive returns. Although lower rates of return have been reported during the recent financial crisis, the downturns ($6,306 millions in total between 2008 and 2011) in the manufactured housing finance market have been offset by the continued increase of manufactured home loan and return volumes ($10,507 millions) between 2012 and 2014.

2. Manufactured home loans provide low-risk investment opportunities.

Finding high-quality, “safe” assets to add to your credit unions’ loan portfolio can be a real challenge. But not at Triad Financial Services. Over the years, our experienced financial experts have developed a variety of manufactured home financing products and refinancing options that are safer and more profitable than other investment alternatives available today. In addition, our professionals have a deep understanding of the secondary market for manufactured home loans and the potential risks associated, being able to direct you toward the best financial products for your portfolio. Having professional financial advice and all the information you need readily available will help you to make better investment decisions, which will not only improve your credit union’s loan portfolio but also allow you to support the local community by offering low-income families access to more affordable housing options.

3. Our manufactured home lending programs ease administrative burdens.

Adding new products to your portfolio often involves building the in-house capacity to keep up with complex regulatory requirements and offer adequate support for new product and service offerings. If you opt for one of our manufactured home lending programs, that’s something you don’t need to worry about. Our dedicated professionals will take care of everything for you, including screening applicants, processing loans, monitoring portfolio performance, communicating with customers and collecting payments from late-paying borrowers.

Though manufactured home loans offer an exceptional opportunity for your credit union to fill a lending gap, you need to formulate your strategy in the midst of changing consumer behaviors and expectations, increasingly competitive markets and unprecedented regulatory challenges that govern the secondary market for the manufactured home loans.

Fortunately, at Triad Financial Services we have the experience and expertise to guide you through all these and help you develop innovative investment strategies to optimize your credit union’s loan portfolio. To discuss your credit union’s situation in more detail, please get in touch with our friendly financial advisors by calling our toll-free number (800)-522-2013 X-1287.